How To Invest In Cryptocurrencies? – A Complete Guideline!

Cryptocurrencies have taken the financial world by storm, offering unique opportunities for investors to diversify their portfolios and potentially achieve significant returns.

Investing in cryptocurrencies can be a rewarding venture for those willing to navigate the complexities of this dynamic market.

In this comprehensive guide, we will delve into the intricacies of cryptocurrency investments, providing you with the knowledge and insights needed to navigate this dynamic market.

Understanding Cryptocurrencies

1. Definition and Characteristics

At its core, a cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology.

2. Popular Cryptocurrencies

Bitcoin, the pioneer cryptocurrency, remains a household name. Ethereum, Ripple, and Litecoin are among the other major players, each with its unique features and use cases. Understanding these cryptocurrencies is essential for informed investment decisions.

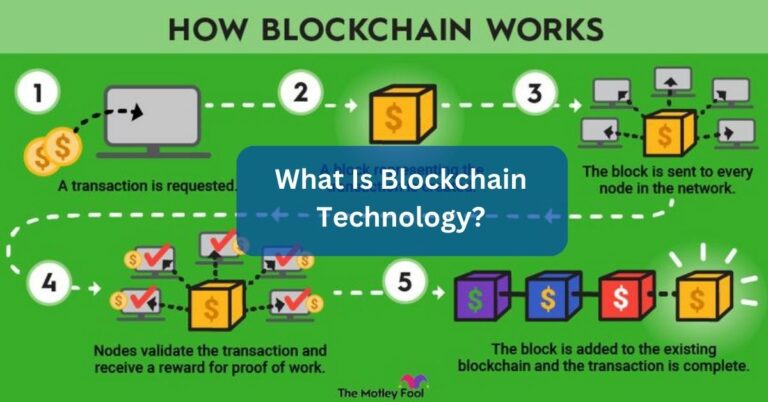

3. Blockchain Technology Explained

Blockchain serves as the backbone of cryptocurrencies, providing a secure and transparent ledger of all transactions. This decentralized and distributed technology ensures the integrity of the cryptocurrency ecosystem.

The Rise of Cryptocurrency Investments

1. Historical Perspective

The journey of cryptocurrencies dates back to the introduction of Bitcoin in 2009. Since then, the market has experienced remarkable growth, attracting both individual and institutional investors.

2. Factors Contributing to the Surge in Popularity

Increased awareness, technological advancements, and growing acceptance of cryptocurrencies by mainstream businesses contribute to the widespread interest in cryptocurrency investments.

Benefits of Investing in Cryptocurrencies

1. Potential for High Returns

One of the primary attractions of cryptocurrency investments is the potential for high returns. The market’s volatility, while a risk, also presents opportunities for substantial gains.

2. Diversification of Investment Portfolio

Cryptocurrencies offer an alternative asset class, allowing investors to diversify their portfolios beyond traditional stocks and bonds. This diversification can enhance overall risk management.

3. Accessibility and Ease of Transactions

Cryptocurrency transactions are conducted digitally, providing accessibility to a global audience. Moreover, the speed and efficiency of transactions contribute to the appeal of cryptocurrency investments.

Risks and Challenges

1. Volatility in the Cryptocurrency Market

The cryptocurrency market is known for its price volatility. While volatility can lead to profit opportunities, it also poses risks for investors, requiring a strategic and disciplined approach.

2. Security Concerns

Security is a paramount concern in the cryptocurrency space. Investors must take measures to secure their digital assets, such as using reputable wallets and exchanges.

3. Regulatory Uncertainties

The regulatory landscape for cryptocurrencies is evolving. Investors should stay informed about regulatory developments and comply with relevant laws to mitigate risks.

How to Start Investing in Cryptocurrencies

1. Research and Education

Before diving into cryptocurrency investments, thorough research is crucial. Understanding the market, different cryptocurrencies, and the technology behind them is essential for making informed decisions.

2. Choosing a Reliable Cryptocurrency Exchange

Selecting a reputable cryptocurrency exchange is a fundamental step. Factors such as security features, fees, and available cryptocurrencies should be considered when choosing a platform.

3. Creating a Secure Wallet

A cryptocurrency wallet is necessary for storing digital assets securely. Hardware wallets, software wallets, and paper wallets are among the options available, each with its advantages and considerations.

Types of Cryptocurrency Investments

1. Buying and Holding (HODLing)

HODLing involves acquiring cryptocurrencies with the intention of holding them for the long term, regardless of short-term market fluctuations. This strategy requires patience and a belief in the long-term potential of the chosen cryptocurrencies.

2. Trading

Active trading involves buying and selling cryptocurrencies based on short-term market movements. Traders use technical analysis and other strategies to capitalize on price fluctuations.

3. Initial Coin Offerings (ICOs) and Token Sales

Investing in ICOs and token sales involves funding new cryptocurrency projects in their early stages. This high-risk, high-reward approach requires careful evaluation of the project’s fundamentals.

Cryptocurrency Investment Strategies

1. Long-Term vs. Short-Term Strategies

Investors must decide whether they aim for long-term growth or short-term gains. Long-term strategies involve patience and a focus on the potential of the technology, while short-term strategies capitalize on market volatility.

2. Dollar-Cost Averaging

Dollar-cost averaging entails investing a fixed amount at regular intervals, regardless of market conditions. This strategy helps mitigate the impact of market fluctuations on the overall investment.

3. Risk Management Techniques

Implementing risk management strategies, such as setting stop-loss orders and diversifying investments, is crucial for minimizing potential losses in the volatile cryptocurrency market.

Conclusion

In conclusion, investing in cryptocurrencies can be a rewarding venture for those willing to navigate the complexities of this dynamic market. By understanding the fundamentals, employing sound investment strategies, and staying informed, investors can harness the potential of cryptocurrencies while mitigating risks.

Frequently Asked Questions (FAQs)

1. Is investing in cryptocurrencies risky?

Cryptocurrency investments carry inherent risks due to market volatility, regulatory uncertainties, and security concerns. It’s crucial to conduct thorough research and make informed decisions.

2. How do I choose a reliable cryptocurrency exchange?

Consider factors such as security features, fees, user interface, and the range of available cryptocurrencies when selecting a cryptocurrency exchange.

3. What is the best strategy for cryptocurrency investments: long-term or short-term?

The best strategy depends on individual goals and risk tolerance. Long-term strategies focus on the potential of technology, while short-term strategies capitalize on market fluctuations.

4. Are there tax implications for cryptocurrency investments?

Yes, cryptocurrency transactions may have tax implications. It’s essential to understand and comply with tax regulations in your jurisdiction.

5. How can I secure my cryptocurrency investments?

Use secure wallets, implement strong password practices, enable two-factor authentication, and stay vigilant against phishing attempts to enhance the security of your cryptocurrency investments.